For some years of the past decade (2013 to 2017), I wrote a small series of yearly posts comparing the compensation of Airbus and Boeing CEOs (1). This series started out of conversation with colleagues and I kept it updated to have a record of the evolution and for quick reference in other conversations. I then stopped the series. This post is just an update with the information for the 2024 fiscal year.

Many things happened in the industry in those 7 years (2017 to 2024), but if we focus just on the CEOs from both companies: Tom Enders was replaced by Guillaume Faury at the helm of Airbus; at Boeing, Dennis Muilenburg was replaced by David Calhoun who then left the place for Robert Kelly Ortberg.

As both Boeing and Airbus are public companies, the information about their CEOs compensation is public and can be found in the annual report and proxy statement from each one. I just share the information and sources below for comparison and future reference.

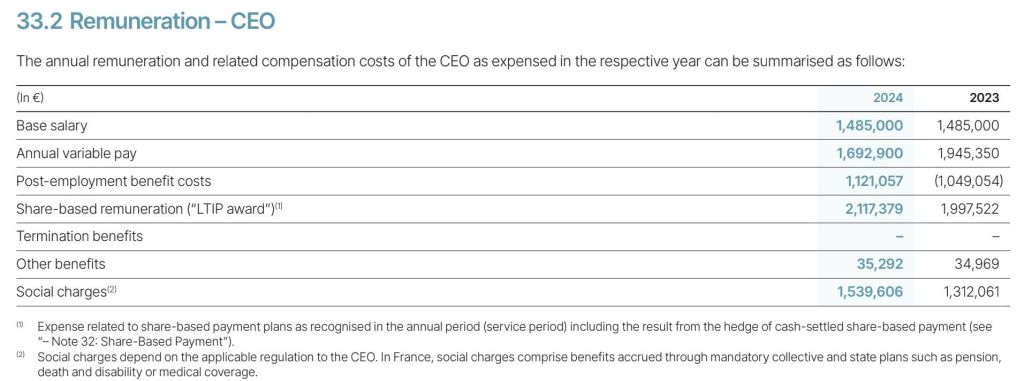

Airbus CEO, Guillaume Faury’s 2024 compensation (financial statements here, PDF, 2.7 MB, page 59):

Faury had his base salary frozen in relation to 2024 at 1.485M€ (which is lower than Enders’ one at 1.5 M€ in 2017). Variable pay decreased in 13% to 1.69M€, post-employment benefit costs increased, as did share-based remuneration and social charges. In comparison to 2017, the main changes are that there are no “Termination benefits” in 2024 while in 2017 Enders had announced his departure in 2019, thus the concept included 2.9M€ and the exponential increase of social charges: 1.5M€ in 2024 vs 12k€ in 2017. Thus, the overall compensation at 7.99M€ increased vs 2023 but is below 2017 level (9.1 M€).

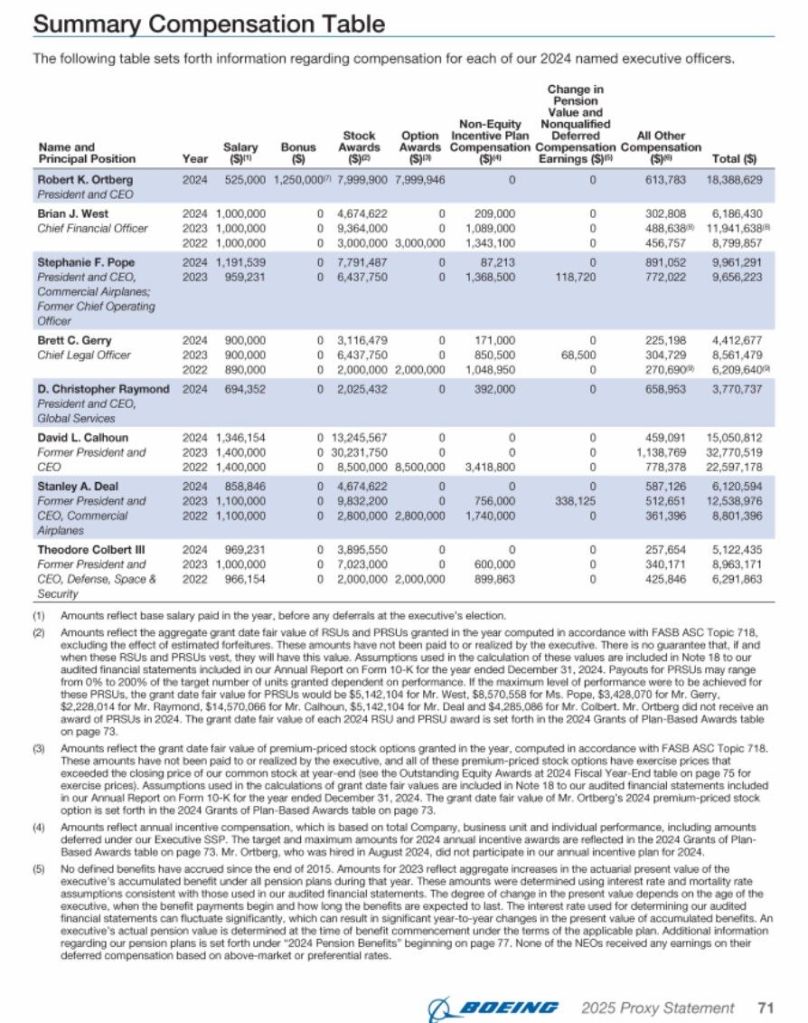

Boeing CEO, Robert Kelly Ortberg’s 2024 compensation (2025 proxy statement here, page 71):

Robert Kelly Ortberg had a base salary of 0.5M$, one bonus of 1.25M$ and 16M$ in stock based awards. The 2024 total compensation was 18.39M$, very similar to 2017 levels, but…

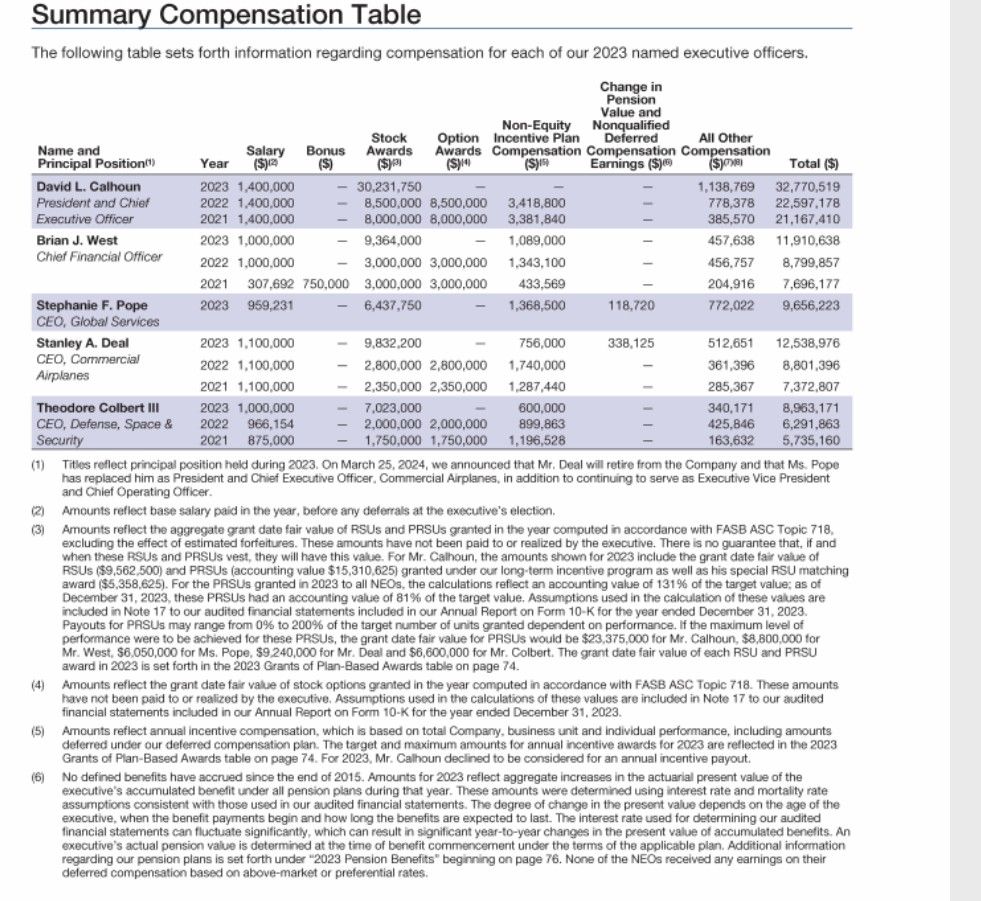

In the table you can also find the compensation for David Calhoun, and this is because Ortberg took over as CEO only in August of 2024. I will therefore add for comparison purposes the same table for Boeing 2023 fiscal year (2024 proxy here, page 72) when only Calhoun served as CEO.

David Calhoun had a base salary of 1.4M$, 30M$ in stock based awards and another 1.1M$ component. The 2023 total compensation was 32.77M$, 77% higher than 2017 levels, or +14M$.

Comparison. It is interesting to note that while the base salary is nearly the same in both companies, ~ 1.5 m€, the much higher stock based incentive schemes at Boeing push up the total remuneration for the CEO to about four times (x4.1) the one in Airbus.

(1) See the previous comparisons for the years 2013, 2014, 2015, 2016 and 2017.