For the last 4 years I have been writting a small series of posts comparing the compensation of Airbus and Boeing CEOs (1). This series started out of conversation with colleagues and I keep it updated to have a record of the evolution and for quick reference in other conversations (2). Thus, this post is just the update with the information for the 2017 fiscal year.

As both Boeing and Airbus are public companies, the information about their CEOs compensation is public and can be found in the annual report and proxy statement from each one. I just share the information and sources below for comparison and future reference.

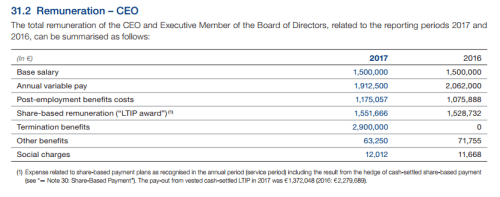

Airbus CEO, Tom Enders’ 2017 compensation (financial statements here, PDF, 4.0 MB, page 58):

Airbus CEO Tom Enders 2017 compensation.

Enders saw his base salary frozen in relation to 2016 at 1.5 M€. Variable pay decreased in 7.3%, post-employment benefit costs increased, etc. The main change in last year’s remuneration was the line “Termination benefits”, which in the notes it is explaiend as stipulated in 1.5 times the “Total Target Remuneration (defined as Base Salary and target Annual Variable Remuneration)”, as Enders announced that he will retire from the post when his current term expires in 2019. Thus, the overall compensation (9.1 M€) increased.

Boeing CEO, Dennis Muilenburg’s 2017 compensation (2018 proxy statement here, PDF, 6.7 MB, page 30):

Boeing’s CEO Dennis Muilenburg 2017 compensation.

Dennis Muilenburg saw his base salary increased in 50 k$. And with that all other incentive and other compensation concepts. The total compensation (18.45 M$) increased in relation to 2016 and has now raised above the 2014 levels (17.8 M$).

Comparison. It is interesting to note that while the base salary is nearly the same, 1.5 m€ vs 1.69 m$ (more so taking into account average exchange rates in 2017 (~ 1.13 USD/EUR)), the incentive schemes at Boeing end up with a total remuneration for the CEO about the double (x1.8) of that in Airbus.

(1) See the previous comparisons for the years 2013, 2014, 2015 and 2016.

(2) From what I see in the stats of the visits to this blog, other people are having similar conversations as these posts with the compensation comparison have ranked among the top 10 most read ones the last years.