Probably you remember having seen in some magazines ads paid by airlines showing their luxury A380 cabins. Singapore Airlines was the first one in launching this kind of branding campaigns.

According to the definition by the Business Dictionary: “Branding aims to establish a significant and differentiated presence in the market that attracts and retains loyal customers.”

Few days ago, I received an email with publicity from a company that operates the A380. As you can see, they go a step beyond: they now use the A380 not only for branding but for advertising a concrete product, a specific flight. In one of the destinations offered you may see a label indicating that the flight is served by an A380.

From the Wikipedia: “Advertising is a form of communication intended to persuade an audience to purchase or take some action upon products, ideas, or services.”

If they use it there must be a reason behind. I have heard from colleagues that, in fact, the companies already operating it in some of their routes are noticing that repeatedly the connections offered by an A380 show higher passenger load factor or occupancy rates than the same connections when offered by a different aircraft.

I have never seen anything like this before. It could have happened when the B-747 entered into service in the 70’s, but I was not here then; I didn’t witness it. It doesn’t happen now; not with the 747 nor with other aircraft. I certainly do not base my buying decisions, when I have to flight within Europe, on whether the airline operates a B-737 or an A320 (maybe I should!). But exactly this is happening in the case of the A380. And airlines are profiting from it.

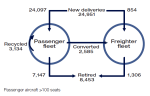

In a previous post I wrote about the difference in current forecasts for the A380 that Airbus and Boeing report (Boeing has steeply reduced its reported forecast in the past decade). If the appeal of the aircraft continues to bring customers in, we could have a reason to believe that in end the orders figure of A380 maybe rather high. Only time and the market will let us know.

In its website, Airbus dubs the A380 as game-changer. One could expect this when a company is talking about one of its products, however when others are basing its branding and advertising on it, we seem to be really facing a game-changer.