Hace unos días leía una noticia con cifras sobre estimaciones del valor de las descargas de un estudio encargado por la Coalición de Creadores e Industrias de Contenidos (CCIC). En ella hablaban del orden de 10.000 millones de euros al año. Y, claro, pensé “¿se han vuelto locos?”

Con este post no pretendo argumentar en contra de la Ley Sinde, ni explicar porque puede ser una mala ley, o aportar un grano de arena en el sentido de hacia donde crea yo que debe ir la industria cultural, ni defender que las descargas no son ilegales, etc… No. Para eso, ya hay otra serie de personas que han escrito muy buenas entradas en sus respectivos blogs o artículos en periódicos (Enrique Dans, Julio Alonso, Juan Carlos Rodríguez Ibarra, Jesús Encinar, etc…).

En este post solo quiero juntar una serie de cifras para que veamos lo absurdo y disparatado de las estimaciones que se hacen y publican desde la industria cultural. Así que voy a repasar el espectro cultural de mayor facturación a menor.

Libros

El sector editorial facturó en 2009 3.109 millones de euros (dato de la Federación de Gremios de Editores de España).

- Es cierto que en 2009 cayeron las ventas un 2,4% respecto a 2008, pero es que hubo una crisis de por medio (!), quiero recordar en el 2009 el PIB de España cayó un 3,6%.

- De hecho en los últimos 10 años las ventas del sector editorial han aumentado un 19,3%.

- En 2009 se editaron 76.213 títulos, un 4,4% más que el año anterior. Si la oferta de libros crece a ese ritmo, necesariamente los ingresos por libro, en media han de disminuir. Cada vez la oferta cultural es mayor y como publicaba en un post Jesús Encinar, el valor de las obras debe tender a cero.

- El libro digital todavía solo representaba un 1,64% de la facturación total.

- Del orden del 28% de las ventas son debidas a libros de texto no universitario… es decir, año tras año se hace pagar a las familias españolas ~870 millones de euros en libros de texto del colegio porque se ha cambiado una coma, porque la forma de sumar y restar es diferente a como era en 2008, y porque la Historia desde el paleolítico a la transición y entrada en Europa ha cambiado (nunca se llegaba a más en las clases de Historia)… (esto sí es piratería).

La literatura no se acaba.

Cine

En el caso del cine los datos son del Ministerio de Cultura, encontrados vía el blog Periodistas 21. El cine en 2009 facturó 671 millones de euros:

- Un 8.4% más que en 2008.

- Un 35% más que hace 10 años. Esto es un crecimiento anual del 3.1%.

- El cine español recaudó 104 millones de euros en 2009 frente a 69 millones en 1999. Esto es un 51% más que hace 10 años (!) o un 4,2% más cada año.

- El cine español en estos 10 años ha mantenido constante su cuota de mercado frente al norteamericano, y si acaso la ha aumentado (15,55%).

- En 2009 había un 22.1% más de salas que en 1999.

- Alguien dirá que en 2009 hubo menos espectadores: 110 millones frente a 131 en 1999.

- A mí esto lo que me sugiere es que el coste medio por entrada en 1999 eran 3,8€ (630 pesetas) mientras que en 2009 eran 6,1€, un 61.1% mayor! Esto es un incremento anual del 4,9% (¿a quién le han subido el sueldo los últimos 10 años un 4,9% al año?)

Ayudas al cine

En el año 2009 se aprobaron en los presupuestos 87 millones de euros en ayudas al cine (de los que se ejecutaron 76 millones).

- Esto es el cine español ingresa en taquilla 104 millones y recibe en subvenciones 87 millones. Es decir, el 46% de los ingresos procede de las subvenciones.

- En 2009 se realizaron 135 largometrajes íntegramente españoles, frente a 44 en 1999 (!), esto es más de 3 veces más o un crecimiento ininterrumpido del 12% al año.

- Si la producción de largometrajes aumenta a ese ritmo (12% año), naturalmente resulta insostenible que cada película pueda vivir de los ingresos de taquilla por mucho que estos aumenten (4,2% al año) a un ritmo mucho mayor que la economía y los salarios de los consumidores. A este ritmo, el valor de las películas de nuevo debe tender a cero.

El cine no se acaba.

Música

Ventas de discos

De nuevo desde el blog Periodistas 21, he accedido a las cifras de Federación Internacional de la Industria Discrográfica (IFPI), quien para España usa las cifras de Promusicae (PDF).

- En 2009 ingresaron 211 millones de euros. Un 17% menos en 2008, y un 71% menos que en 2001. Esto es un -11,8% al año.

- En ese mismo informe se indica que las ventas digitales aumentaron un 10,6%, hasta los 32 millones de €… (eso es no querer ver una tendencia).

SGAE

La SGAE ingresó en 2009 317 millones de euros (canon incluido), un 5,1% menos que en 2008.

- De ellos, 27,67 millones de euros fueron gracias al canon digital, un 9% de la facturación. Esto es un 72,9% más que en el año anterior.

- De ellos, más de 120 millones de euros provenientes únicamente por el pago de tasas de cadenas de televisión y radio, un 37% de su facturación total.

- Los derechos de autor generados de la venta de discos y otras obras en soporte físico (CD y DVD fundamentalmente) ascendieron a 20,46 millones de euros, un 30,5% menos que en 2008. Las cifras de SGAE hablan de ingresos de 60 millones en 2000. Esto supondría una caída del 66% o un -10% anual.

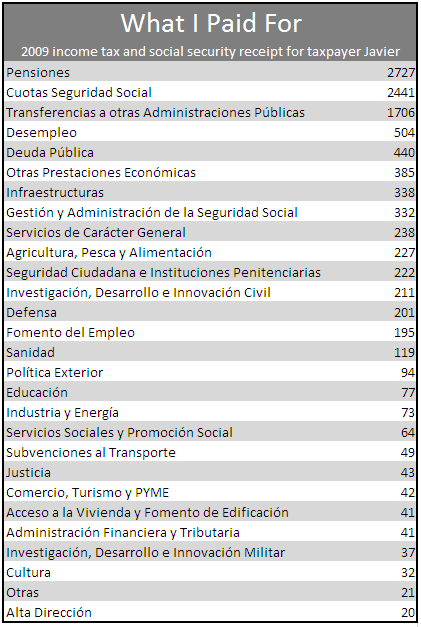

- Si de los 211 millones de la venta de discos, solo 20,46 millones fueron a parar a los autores, hay un 90,3% del negocio que se lo están quedando los intermediarios (hay que tener en cuenta que los 20,46 M€ corresponden solo a SGAE y hay otras sociedades, que entre todas suponen un 28% del mercado… luego realmente el procentaje que se queden los intermediarios debe ser del orden del ~87%)

- La SGAE repartió 346 millones de euros (un 6,1% menos que en 2008) entre sus 32.106 socios nacionales y los 181.099 artistas extranjeros representados por otras sociedades; esto es una media de 1.623 euros por artista (suponiendo que lo repartiesen a partes iguales… pero no es así, el 1,73% de los autores se reparte el 75% de los ingresos).

Canon digital

Los ingresos totales por el canon digital en 2009 fueron de 93 millones de euros, entre todas las sociedades de gestión.

El Gobierno publicó una Orden ministerial en 2008, donde determinaba unos límites para compensación equitativa por copia privada de entre 37,2 y 34,8 millones de euros para la modalidad de reproducción de libros, y de entre 75,4 y 80,6 millones de euros para la modalidad de reproducción sonora y audiovisual.

***

Una vez hecho este repaso vemos que toda esta industria cultural apenas superó los 4.000 millones de euros… lejos de los 10.000 que pretenden hacernos creer que están perdiendo debido a las descargas. Estos 4.000 millones se producen después de que el sector editorial y el del cine, que son de largo los mayores, hayan crecido en los últimos 10 años.

Por último, leía en otro artículo hace unos días que a través de estudios de Nielsen y de publicidad se llegaba a que la cifra de volumen de negocio que pueden manejar unas 300 páginas de descargas es de entre 150 y 170 millones de euros anuales.

Comparación volúmenes de negocio de la industria cultural.

Si tomamos esas cifras como buenas, y dado que ese es el camino que indica la demanda, la industria lo tendría muy fácil: replicar esas páginas de enlaces y dar ese valor añadido que ofrecen las actuales páginas. Con mejores versiones/grabaciones de las películas conseguirían ganar en tráfico. Si lo hicieran bien se llevarían esos 150 millones de euros (verían como nunca son 10.000 millones).

Ah, y una vez hiciesen eso, imagino que tendrían la vergüenza torera de devolver el canon, dado que el “Tribunal de la UE declara que dicha tasa es ilegal y no se puede aplicar a empresas y profesionales que adquieren equipos y soportes de reproducción de contenidos digitales ya que el uso que le dan es ajeno a la copia privada”.