Last week, just ahead of Le Bourget air show, Boeing Commercial published its yearly update of the Current Market Outlook (CMO) for the next 20 years of commercial aircraft market (2013-2032).

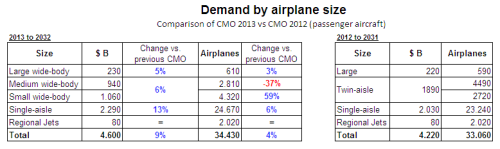

I just compared the figures for passenger aircraft of the last two years’ CMOs:

Some comments to it:

- You can see that the total number of new aircraft delivered has slightly increased from 33,060 to 34,430, a 4%, which is consistent with the constant 5% traffic increase that Boeing predicts.

- The volume (Bn$) increases by a larger percentage, 9% (380 Bn$)… this is due mainly to the double increase in:

- (1) single-aisle aircraft expected sales 6,2% (+1,430 aircraft), and

- (2) the average price list with which the list is computed, another 6.3% (from 87.3m$ to 92.8m$)

- I am puzzled to see the the sudden change in the predicted mix of twin-aisle sales, between small and medium wide-bodies…

- small wide-bodies: from 2,720 a/c in CMO2012 to 4,320 a/c in CMO2013, whereas,

- medium wide-bodies: from 4,490 a/c in CMO2012 to 2,810 a/c in CMO2013

- as you can see the combined figure slightly changes (7,130 vs. 7,210), however the distribution among the two categories is drastically changed. Why is that? A question to Randy Tinseth that he did not address in his blog when the CMO was unveiled.

I would tend to think that the move is done to push some market development based on some models (787) instead of others (777), but given that it is precisely now when the upgraded versions of the 777 are supposed to be pushed into the market I fail to see the logic behind this.

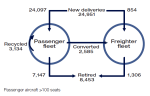

Find below the nice infographic that the guys from Boeing have put up together:

Boeing Commercial Aviation Market Forecast 2013-2032 infographic.

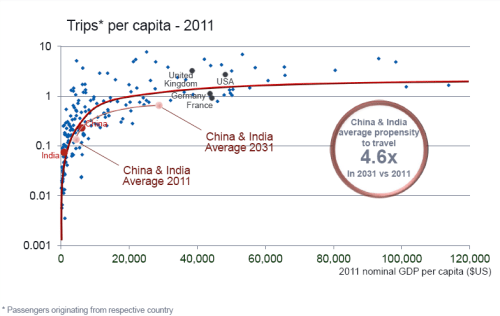

As always, I recommend going through the CMO, as you can learn a lot about the business: from global numbers, to growth, traffic figures, fleet distributions, forecasts, etc… You may find the presentation [PDF, 9.6 MB], the booklet [PDF, 3.0 MB] and the file [XLS, 0.4 MB] with all the data.

For a comparison between this CMO and the respective Airbus’ GMF we will have to wait until after the summer, when Airbus publishes its update. Until then, find here the comparison based on 2012 market studies.