About two years ago I wrote a post, KC-46 EMD contract 101, in which I reviewed the nature, implications and status of the Fixed Price plus Incentive Firm (FPIF) that the US Air Force had signed with Boeing for the tanker K-46 Engineering Manufacturing and Development (EMD) contract.

I have been wanting to write an update of that post with how the situation has evolved for some months. The recent article in Bloomberg, “Boeing KC-46 Tanker Suppliers Behind on Deliveries, GAO Finds“, has finally triggered this review.

A recap of the main points from the Bloomberg article:

[…] The boom for the first KC-46 has been “delayed by eight months due to design changes and late parts deliveries,” […]

The delays have resulted in a slip of at least three months in the initial flight of the first fully equipped development aircraft. […]

[…] GAO said “another supplier has experienced significant delays in manufacturing” aerial refueling wing pods […]

[…] the Air Force projected in a revised estimate this year that Boeing will have to absorb $1.5 billion for exceeding a $4.8 billion ceiling to develop the first four planes.

Bloomberg cites GAO as a source. GAO stands for US Government Accountability Office. Every year, in March, the GAO releases its “Assessments of Selected Weapon Programs” where it reviews the Department of Defense (DoD) main programs. Find here [PDF, 10.4MB] the 2015 report released on March 12. It contains just 2 pages about the “KC-46 Tanker Modernization Program (KC-46A)”. What does it say? Main take aways:

[…] After the critical design review, the program had wiring design changes that led to several delays, including at least a three month delay to KC-46 first flight. The program does not plan to demonstrate a full system-level prototype until April 2015, 21 months after its critical design review. […]

[…] key suppliers have continued to experience difficulties with the design and manufacture of aerial refueling systems, such as refueling booms and wing aerial refueling pods. The boom that was to be installed on the first KC-46 has been delayed by eight months due to design changes and late parts deliveries. Another supplier has experienced significant delays in manufacturing wing aerial refueling pods for qualification testing and development aircraft due, in part, to challenges with parts delays and engineering design changes. As a result of these delays, first flight of an aircraft that integrates military sub-systems has slipped at least three months to April 2015, 21 months after critical design review. […]

[…] Boeing is encountering more than twice the number of software problems than originally estimated that prevent or adversely affect the accomplishment of an essential operational or test capability.

[…] the program office noted that it has mitigated financial risk with the competitive fixed-price incentive development contract with firm-fixed and not-to-exceed pricing for the production of the aircraft. More than 57 percent of the development work has been completed. Boeing has met or exceeded all contractual requirements. […]

The program performance review that the GAO makes is seen from the Air Force point of view, which, as indicated above, since the contract is a FPIF, the USAF feels protected and thus it does not show any sign of the 1.5bn$ over cost that Bloomberg mentions that Boeing will have to bear:

Program Performance (fiscal year 2015 dollars in millions)

Bloomberg quotes a 1.5bn$

estimated over cost based on Air Force data.

The GAO published in March 2012 [PDF, 1.1MB], February 2013 [PDF, 1.2MB] and April 2014 [PDF, 1MB] three reports reviewing the KC-46 tanker program. Interestingly enough the reports from 2012 and 2013 included such estimates of the over cost using Air Force data, the 2014 report did not. See 2012 and 2013 estimates below:

KC-46 EMD Contract & Estimates (March 2012).

KC-46 EMD Contract & Estimates (February 2013).

Why did the GAO not include such estimate in 2014 report? Wasn’t the information available? The release of such estimates in 2012 and 2013 did not sit well in some spheres?

Today is March 21st 2015. I guess we shall see soon the annual report from the GAO with the specific view on the KC-46 program. I wonder whether such cost estimate will be included this time (hopefully yes). In any case, I guess the information from the Air Force estimate has been duly leaked.

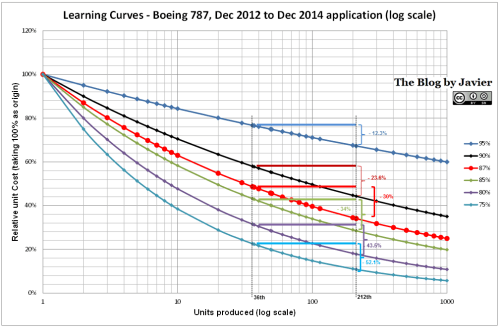

The contract was awarded on February 24th 2011; about a year later USAF was already estimating that Boeing suffered already over 750m$ over costs from target price, 260m$ over ceiling price. For the Air Force the picture was bleaker. One year later the figures had increased again. Luckily for USAF the FPIF contract has a point of total assumption on the side of the contractor (Boeing), as I indicated in the post from 2013:

KC-46 EMD FPIF Contract (March 2013).

Let’s see where we would be now in the previous curve taking the information from Bloomberg as good (“[…] the Air Force projected in a revised estimate this year that Boeing will have to absorb $1.5 billion for exceeding a $4.8 billion ceiling to develop the first four planes.”):

KC-46 EMD FPIF Contract (March 2015 update, based on Bloomberg)

As I mentioned in the blog post from 2 years ago: this is the typical FPIF contract curve, which is the only thing which is missing in ALL the news, budgeting materials, GAO reports, etc., that I have read and is the most illustrative graphic to understand what is going to happen if the cost overruns keep piling and who is going to bear which amount of the cost from which point.

Bloomberg and the US Air Force estimate that those 1.5bn$ over the ceiling price are going to be born by Boeing as the FPIF contract stipulates. However, I wanted to call here the attention to the FY2016 budget request from the USAF (DoD) [here, PDF, 8.5MB], see below:

See “Total Cost” and “Remark” (source: Exhibit R-3, RDT&E Project Cost Analysis: PB 2016 Air Force).

As you can see the USAF budget request for the KC-46 program includes the remark:

The contract ceiling price of $4.9B is the government’s maximum financial liability on the prime contract. The “Total Cost” value represents the Milestone B Service Cost Position (SCP), which accounts for the ceiling price of the contract plus the financial risk of potential design changes for the KC-46 Aircraft.

I would not discard that through the justification of “design changes” the American tax payer will have to bear part of those estimated 1.5bn$ over the ceiling price. We will see.

Finally, I think it interesing to see the planning included in the budget request from USAF (below), as it indicates a Tanker First Flight in the 3rd quarter of 2015 (not April 2015 as quoted by Bloomberg (“initial flight of the first fully equipped development aircraft”)).

USAF FY2016 budget request – KC-46 Planning.

You can compare it with the planning presented in February 2012 with FY2013 budget resquest:

USAF FY2013 budget request – KC-46 Planning.

The GAO talks about a “first flight of an aircraft that integrates military sub-systems has slipped at least three months to April 2015”, but in my view that doesn’t mean a “first fully equipped development aircraft”. In 2012 the planning had a tanker first flight at the beginning of Q2 2015 which in the 2015 plan it is shown in Q3 2015, thus the 3-month delay mentioned by the GAO.

I am indeed looking forward to the KC-46-specific report from the GAO that may be about to be published (1).

—

(1) I may then have to write another post with a new update.